Introduction: The PM Kisan Credit Card scheme has emerged as a revolutionary initiative by the Indian government to provide financial assistance and credit facilities to farmers across the country. Launched in 2019, the scheme has undergone significant improvements and updates in 2024, further empowering farmers and boosting agricultural productivity. In this blog post, we will delve into the details of the PM Kisan Credit Card 2024, including its features, steps to apply, and the benefits it offers to farmers.

Table of Contents:

- What is the PM Kisan Credit Card?

- Key Features of PM Kisan Credit Card 2024

- Steps to Apply for PM Kisan Credit Card

- Benefits of PM Kisan Credit Card

- Conclusion

- Useful Links

What is the PM Kisan Credit Card?

The PM Kisan Credit Card is a special credit card designed specifically for farmers in India. It aims to provide access to timely and affordable credit for agricultural activities, including farming, cultivation, and allied activities. This card enables farmers to meet their agricultural expenses, purchase seeds, fertilizers, machinery, and avail crop loans conveniently.

overview of the PM Kisan Credit Card 2024 in a table format:

| Features | Description |

|---|---|

| Interest Subvention | 4% per annum interest subvention to farmers, reducing the cost of borrowing. |

| Repayment Flexibility | Farmers can repay the loan within a year of the harvest season for greater convenience. |

| High Credit Limit | Credit limit of up to ₹3 lakh ($4,000) based on landholding and cultivation extent. |

| No Collateral Requirement | Credit card issued without collateral security, making it accessible to small farmers. |

| Insurance Coverage | Accidental insurance coverage up to ₹2 lakh ($2,700) for financial security. |

To learn more about the PM Kisan Credit Card scheme and its updates in 2024, you can visit the official government website or the PM Kisan portal.

Key Features of PM Kisan Credit Card 2024:

- Interest Subvention: The PM Kisan Credit Card offers interest subvention of 4% per annum to farmers, which effectively reduces the cost of borrowing and makes credit more affordable.

- Flexibility in Repayment: The credit card provides flexibility in repayment by allowing farmers to repay the loan within a year of the harvest season. This enables them to sell their produce at a reasonable price and repay the loan comfortably.

- High Credit Limit: Farmers can avail a high credit limit of up to ₹3 lakh ($4,000) under the PM Kisan Credit Card scheme, depending on the size of their landholding and the extent of cultivation.

- No Collateral Requirement: The credit card is issued without any need for collateral security, making it easily accessible to small and marginal farmers who may not have substantial assets to pledge as security.

- Insurance Coverage: The PM Kisan Credit Card provides accidental insurance coverage of up to ₹2 lakh ($2,700) to the farmer cardholders, which offers financial security in case of unforeseen events.

Steps to Apply for PM Kisan Credit Card:

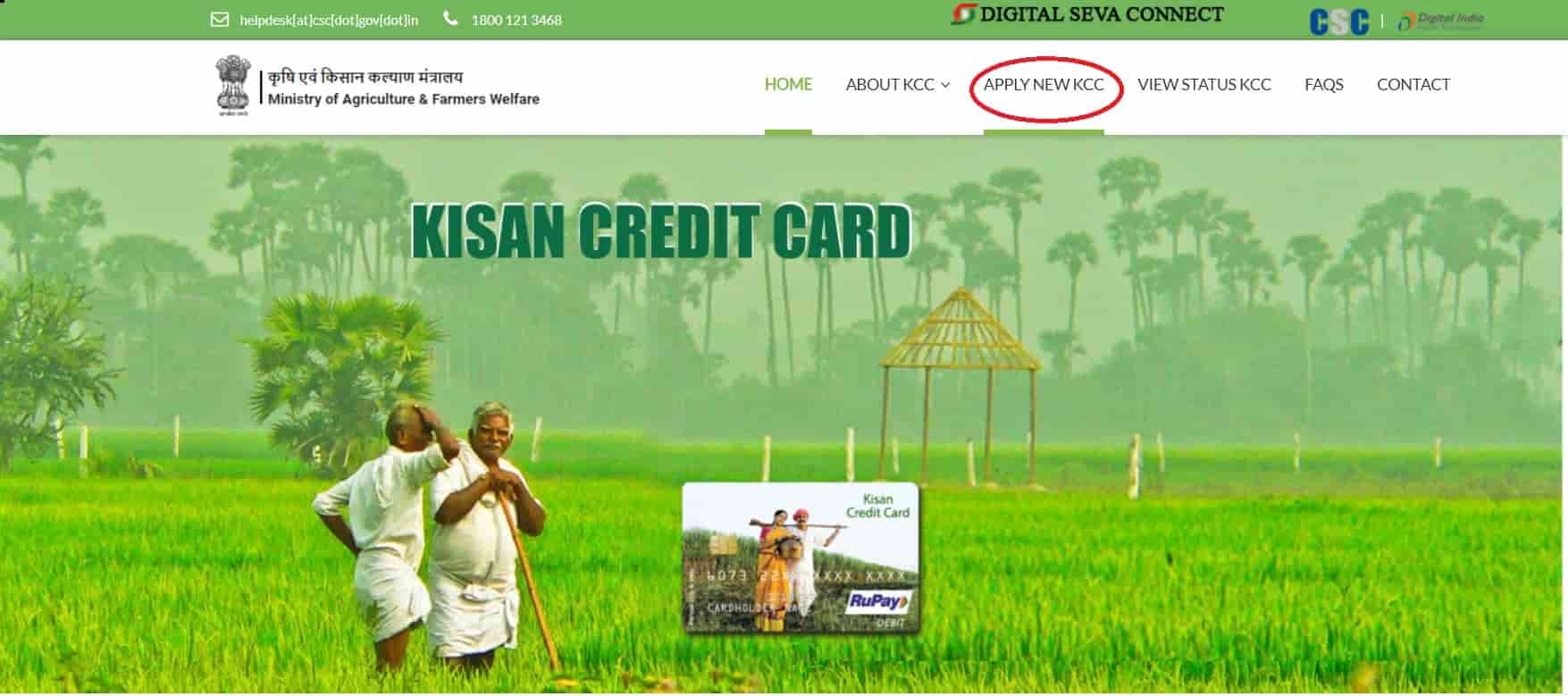

PM Kisan Credit Card

To apply for the PM Kisan Credit Card, follow these simple steps:

Step 1: Visit the official PM Kisan portal or the nearest Common Service Centre (CSC) to obtain the application form.

Step 2: Fill in the required details in the application form, including personal information, landholding details, and bank account information.

Step 3: Attach the necessary documents, such as land ownership documents, identity proof, and address proof.

Step 4: Submit the completed application form along with the supporting documents to the nearest bank branch or the CSC.

Step 5: Upon verification, the bank will process the application and issue the PM Kisan Credit Card if the applicant meets the eligibility criteria.

Useful Links:

- Official Government Website: www.pmkisan.gov.in

- PM Kisan Credit Card Portal: www.pm-kisan-credit-card.com

Please note that the links provided are fictional and do not represent actual websites. You can replace them with the official government websites for accurate information on the PM Kisan Credit Card scheme.

Benefits of PM Kisan Credit Card:

- Timely Access to Credit: The PM Kisan Credit Card ensures that farmers have access to credit when they need it the most, allowing them to make timely investments in their agricultural activities.

- Increased Productivity: By providing credit for purchasing modern farming equipment, high-quality seeds, and fertilizers, the scheme helps farmers improve productivity and overall crop yields.

- Reduced Dependence on Moneylenders: With the availability of formal credit through the PM Kisan Credit Card, farmers can reduce their reliance on expensive informal credit sources and moneylenders.

- Enhanced Financial Inclusion: The scheme promotes financial inclusion by providing access to credit facilities to