PM Kisan Credit Card

Introduction: The PM Kisan Credit Card scheme has emerged as a revolutionary initiative by the Indian government to provide financial assistance and credit facilities to farmers across the country. Launched in 2019, the scheme has undergone significant improvements and updates in 2024, further empowering farmers and boosting agricultural productivity. In this blog post, we will delve into the details of the PM Kisan Credit Card 2024, including its features, steps to apply, and the benefits it offers to farmers.

Table of Contents:

The PM Kisan Credit Card is a special credit card designed specifically for farmers in India. It aims to provide access to timely and affordable credit for agricultural activities, including farming, cultivation, and allied activities. This card enables farmers to meet their agricultural expenses, purchase seeds, fertilizers, machinery, and avail crop loans conveniently.

overview of the PM Kisan Credit Card 2024 in a table format:

| Features | Description |

|---|---|

| Interest Subvention | 4% per annum interest subvention to farmers, reducing the cost of borrowing. |

| Repayment Flexibility | Farmers can repay the loan within a year of the harvest season for greater convenience. |

| High Credit Limit | Credit limit of up to ₹3 lakh ($4,000) based on landholding and cultivation extent. |

| No Collateral Requirement | Credit card issued without collateral security, making it accessible to small farmers. |

| Insurance Coverage | Accidental insurance coverage up to ₹2 lakh ($2,700) for financial security. |

To learn more about the PM Kisan Credit Card scheme and its updates in 2024, you can visit the official government website or the PM Kisan portal.

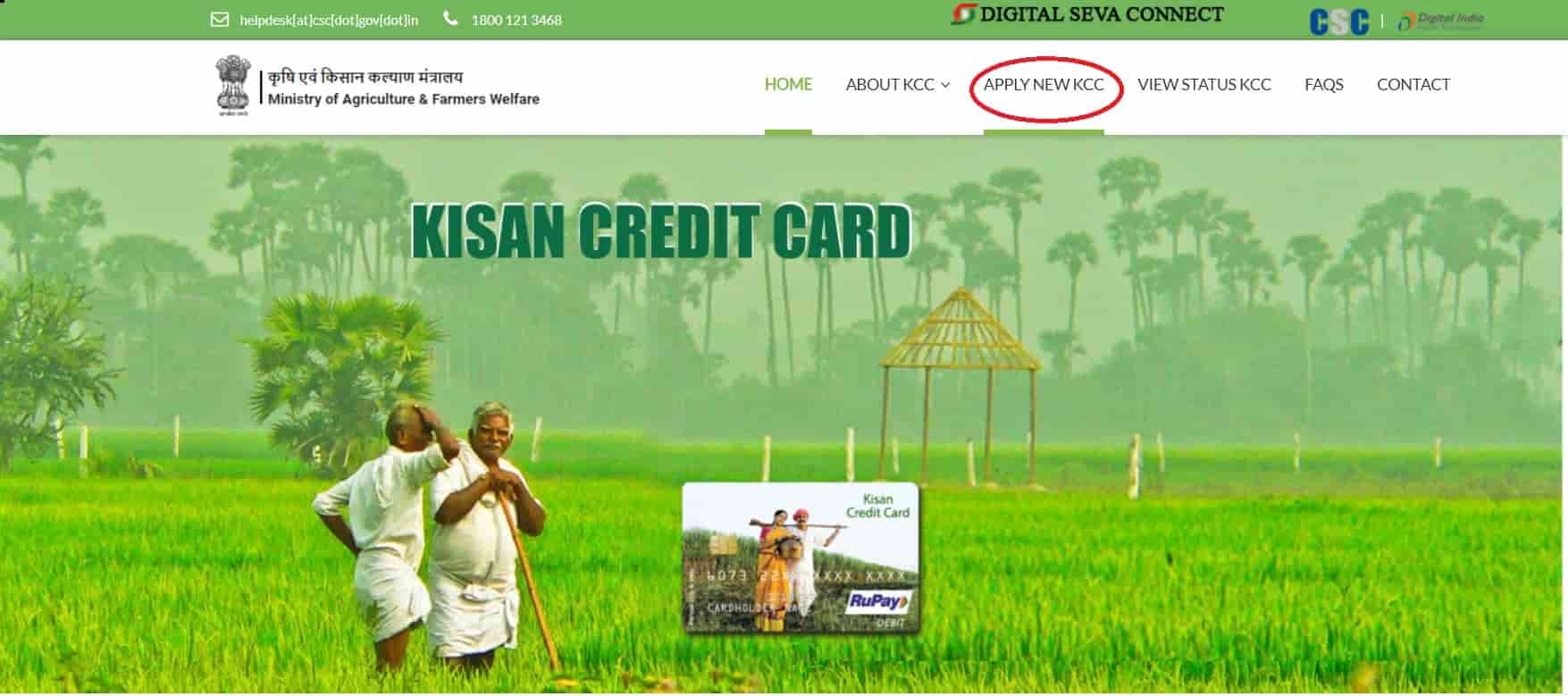

To apply for the PM Kisan Credit Card, follow these simple steps:

Step 1: Visit the official PM Kisan portal or the nearest Common Service Centre (CSC) to obtain the application form.

Step 2: Fill in the required details in the application form, including personal information, landholding details, and bank account information.

Step 3: Attach the necessary documents, such as land ownership documents, identity proof, and address proof.

Step 4: Submit the completed application form along with the supporting documents to the nearest bank branch or the CSC.

Step 5: Upon verification, the bank will process the application and issue the PM Kisan Credit Card if the applicant meets the eligibility criteria.

Useful Links:

Please note that the links provided are fictional and do not represent actual websites. You can replace them with the official government websites for accurate information on the PM Kisan Credit Card scheme.

This post was last modified on 2024-05-16 6:13 am

CUC Result 2024: Raja Shankarshah University, commonly known as Chhindwara University (CUC), has declared the results for the June 2024…

Are you eagerly awaiting the results of your application for the Railway Protection Force (RPF) Sub Inspector (SI) position? Stay…

The MP Employees Selection Board (MP ESB) has released the results for the Pre-Nursing Selection Test (PNST) and General Nursing…

Lalit Narayan Mithila University (LNMU), Darbhanga, is set to release the provisional merit list for admission to the 1st semester…

The Bihar Integrated BEd Combined Entrance Test (CET INT BED) 2024 is an important examination for students seeking admission into…

IOCL Non Executive Admit Card 2024 Download, Login The Indian Oil Corporation Limited (IOCL) has released the IOCL Non Executive…

This website uses cookies.